What impact could the mid-term elections have on stocks?

Many political and market commentators have been issuing forecasts and analyses regarding the Federal elections in November, particularly the prospect of Republicans taking control of the U.S. House of Representatives and the Senate. While BFA does not take political positions and leaves it in the hands of those better-suited for such prognostications, we know what history has to say about how stocks can act during the lead-up to and the year following mid-term elections, regardless of which party is in control.

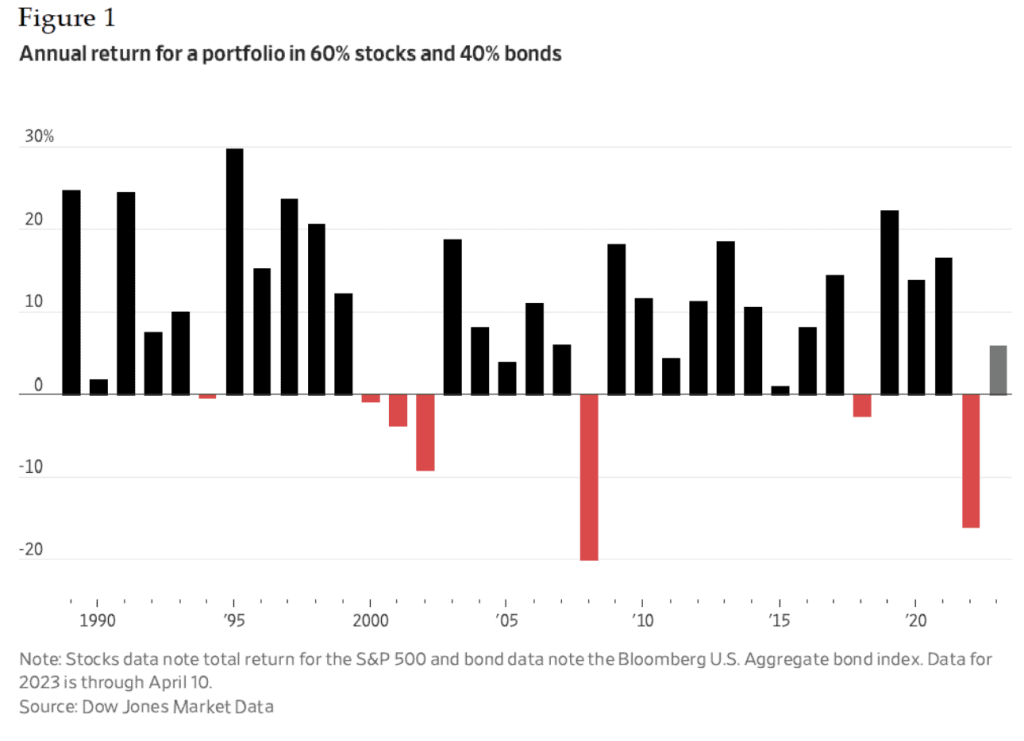

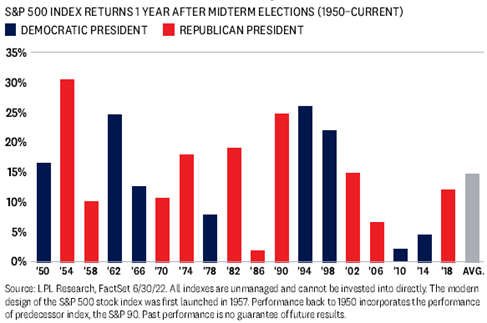

In their 2022 Midyear Outlook, LPL Research reports that mid-term election years have not been kind to equities. In the midterm years since 1950, the S&P 500 (U.S. large-cap stocks) has experienced the largest peak-to-trough pullback (down 17.1% on average) during the four years of the Presidential cycle. Indeed, the S&P 500 on a total return basis was down 24% YTD through September 30, 2022. The good news, however, is that once the uncertainty of the election is over after Election Day, stocks generally rebound, and by quite a bit. As shown in Figure 1, the S&P 500 has increased each year after every midterm election since 1950. The average gain is 14.5%.

Figure 1. This chart shows that the S&P 500 has increased each year after every midterm election since 1950. The average gain is 14.5%.

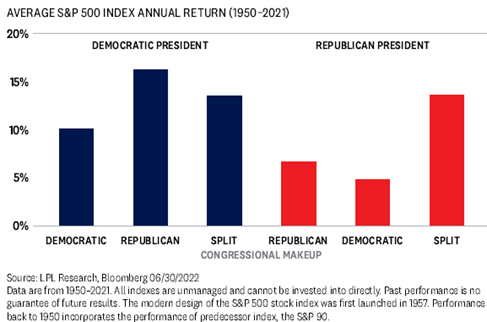

Furthermore, does it matter which political party is in control? The answer is No. As seen in Figure 2, the S&P 500’s average annual return since 1950 has been positive, regardless of the party in the White House or the makeup of Congress. In fact, the market seems to prefer a divided government, which may be the result after November. Your BFA Investment Committee is not worried about the outcome.

Figure 2. This chart shows that the S&P 500’s average annual return since 1950 has been positive, regardless of the party in the White House or the makeup of Congress.

Financial Planning Concepts

TAX INCENTIVES FOR CLEAN ENERGY INVESTMENTS

On August 16th, President Biden signed into law new tax legislation commonly called the “Inflation Reduction Act of 2022.” The legislation includes tax incentives for businesses to invest in clean energy projects and for individual/family taxpayers who spend money on energy-efficient products. The business tax incentives are easily the most extensive portion of the new tax law but there are a few opportunities for individual taxpayers, too.

Clean Vehicle Credits

The new legislation changes the tax incentives for purchasing an electric vehicle (EV). First, there is a transition period where if the vehicle is purchased before August 16th but is not delivered until after, the EV tax credit is based on the prior law: a tax credit of $2,500 + $417 for every kWh over 5 kWh with a maximum credit of $7,500. If the vehicle is purchased after August 16th but before 2023, the EV must also qualify under a new rule called “final assembly”, a requirement that the final assembly of the vehicle must occur in the United States. There is a 200,000 vehicle sales cap in 2022 and many manufacturers (Tesla, GMC, and Chevrolet) have already phased out. You can find a great resource for additional information here: https://www.efile.com/electric-vehicle-car-tax-credits/

It is important to note that in 2023 there are additional qualifying thresholds that relate to the battery components and critical mineral sourcing for new cars. Because of these additional requirements, far fewer cars qualify for the full tax credit. However, some used cars will become eligible for a tax credit that is 30% of the sales price up to $4,000.

Residential Energy Property Expenditures

There are new credit thresholds for “Residential Energy Property”: geothermal heat pumps, small wind turbines (less than 100 kW), solar water heaters, solar panels (photovoltaic systems), residential fuel cell and microturbine systems, biomass stoves with 75% efficiency ratings, and qualified battery storage technology (residential and >3kWh). In 2022, there is a 26% tax credit for systems placed in service before 1/1/2023. After 2022, there is a credit for 30% for 2023-2032, 26% for 2033 and 22% for 2034.

Qualified Energy Efficiency Improvements

Starting in 2023, there is a tax credit equal to 30% of the costs of all eligible home improvements up to $1,200 per year. The annual limits for specific types of qualifying improvements will be: $150 for home energy audits, $250 for any exterior door ($500 total for all exterior doors) that meet applicable Energy Star requirements and $600 for exterior windows and skylights that meet Energy Star most efficient certification requirements. There is a $600 credit for other qualified energy property including central air conditioners, electric panels and certain related equipment, natural gas, propane, or oil water heaters and furnaces. There is a $2,000 credit for heat pumps and heat pump water heaters, biomass stoves and boilers. This category of improvement is not limited by the $1,200 annual limit on total credits or the $600 limit on qualified energy property. Please consult your tax advisor regarding car purchases, property credits and improvements.