How We Work Together

True planning cycle

For us, comprehensive financial planning is really life planning, and our True Planning Cycle demonstrates the ongoing care and peace of mind you’ll receive on your financial journey.

Throughout the year, we follow a continuous, repeatable, and predictable process to guide you to complete financial solutions to help remove the burden and confusion of keeping your money and goals on track. Learn how this time-tested strategy and communication cycle unifies your taxes, estate planning, investments, retirement, and more.

Even Years – spring

Each spring brings new chapters to consider, such as your retirement and risk management. Whether you’re already retired or preparing to retire, we’ll ensure your plans are still on track, including:

- You’re efficiently mitigating risk

- Make sure you are on target to achieve the retirement of your dreams.

- You’re considering your various insurance needs for today and in the future

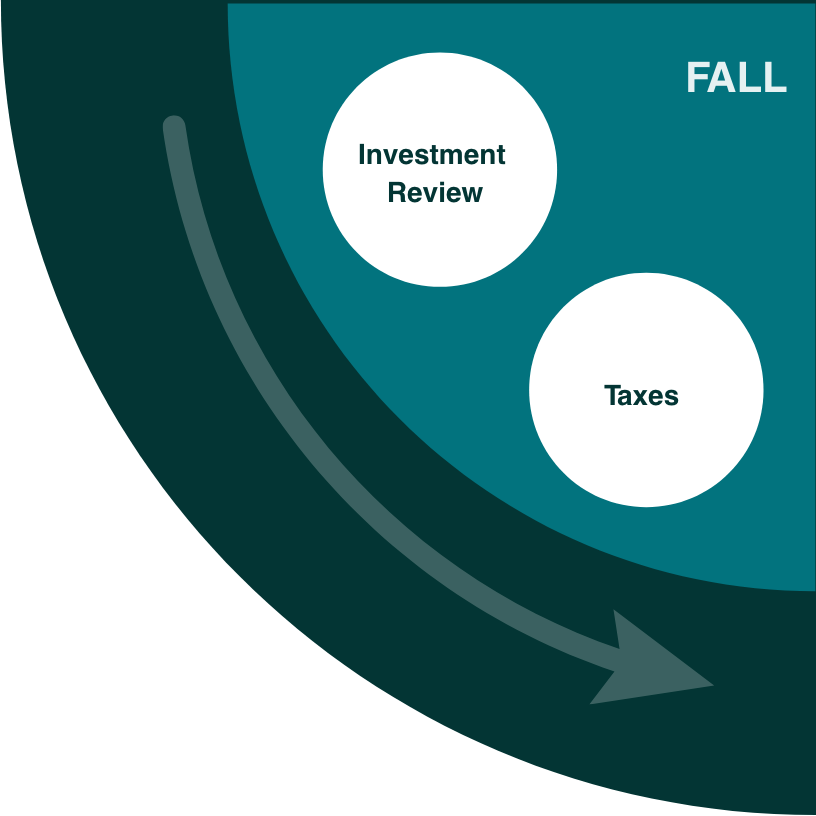

Odd Years – Fall

When preparing for the new year, we’ll help you refine your investment strategy and complete a multi-year tax analysis, including:

- Maximizing your contributions or making required distributions

- Considering other tax-advantaged accounts and assets

- Developing a charitable giving strategy to offset gains and fulfill philanthropic objectives

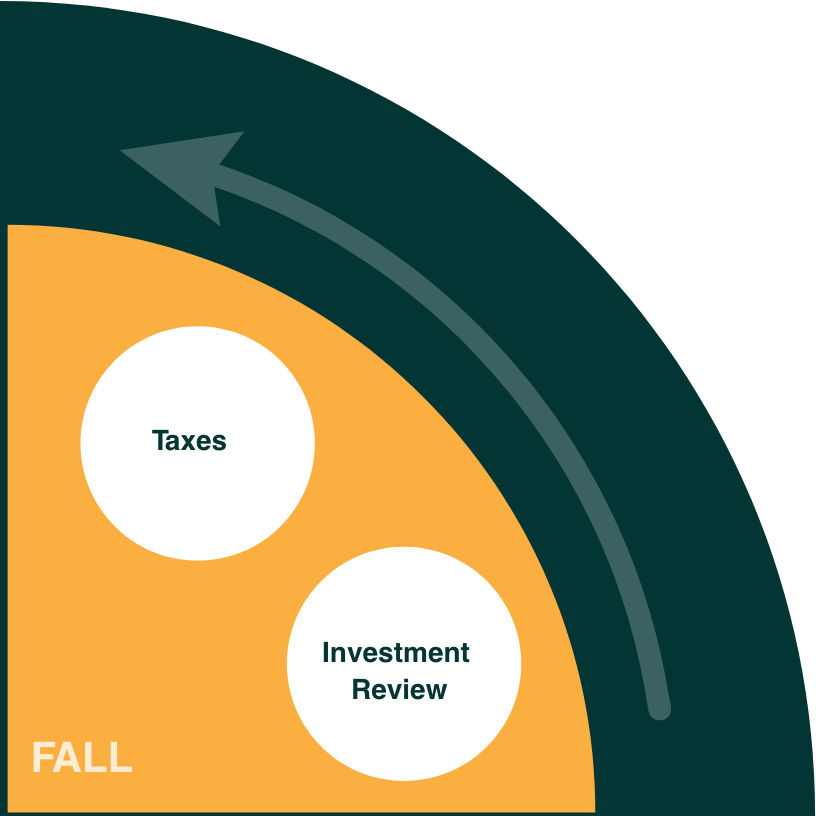

Even Years – Fall

At the end of the year, we’ll take stock of the financial health of your investments and provide a full tax review to help:

- Optimize your income

- Reduce your tax liability

- Leverage portfolio-efficient opportunities, such as tax-loss harvesting

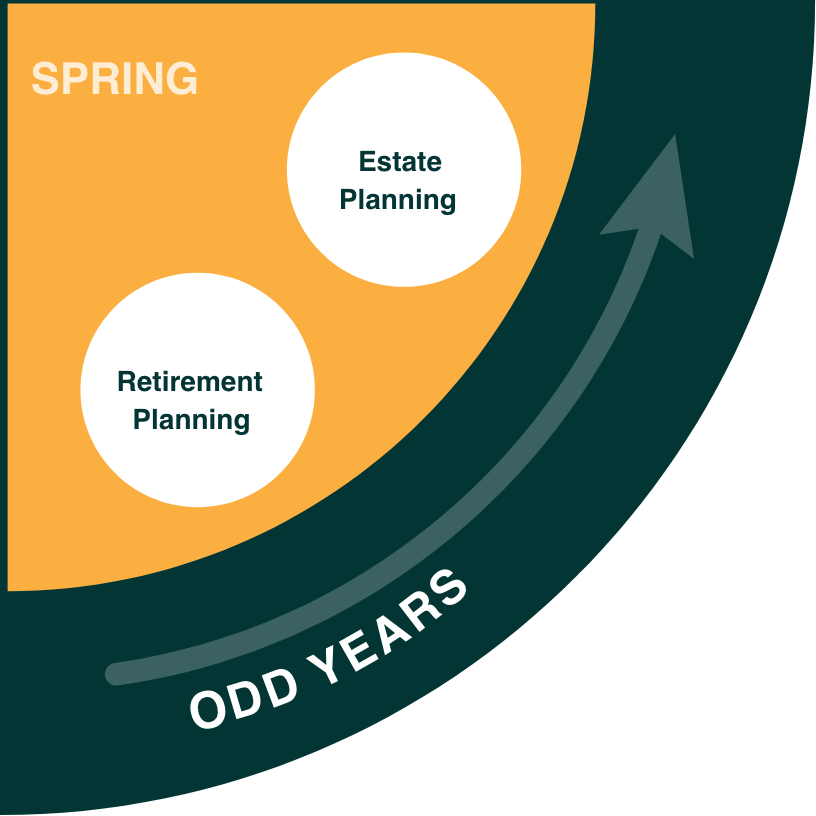

Odd Years – Spring

During this cadence of communications, we will check in to review the progress of your retirement and estate plan, refining them as necessary by:

- Reconfirming your income and expense flows and projecting your wealth into the future

- Deeply exploring your goals to help you achieve your family’s legacy

- Reconfirming your estate plan to help you prepare the next generation while minimizing taxes and excess administration

Even Years – spring

Each spring brings new chapters to consider, such as your retirement and risk management. Whether you’re already retired or preparing to retire, we’ll ensure your plans are still on track, including:

- You’re efficiently mitigating risk

- Make sure you are on target to achieve the retirement of your dreams.

- You’re considering your various insurance needs for today and in the future

Odd Years – Fall

When preparing for the new year, we’ll help you refine your investment strategy and complete a multi-year tax analysis, including:

- Maximizing your contributions or making required distributions

- Considering other tax-advantaged accounts and assets

- Developing a charitable giving strategy to offset gains and fulfill philanthropic objectives

Even Years – Fall

At the end of the year, we’ll take stock of the financial health of your investments and provide a full tax review to help:

- Optimize your income

- Reduce your tax liability

- Leverage portfolio-efficient opportunities, such as tax-loss harvesting

Odd Years – Spring

During this cadence of communications, we will check in to review the progress of your retirement and estate plan, refining them as necessary by:

- Reconfirming your income and expense flows and projecting your wealth into the future

- Deeply exploring your goals to help you achieve your family’s legacy

- Reconfirming your estate plan to help you prepare the next generation while minimizing taxes and excess administration

Pave a Clear, Brighter Path Forward

Wealth Management Services

Discover our common-sense approach to help reduce investment risk while maximizing the potential in your investment portfolio.