What effect does being out of the market have on my portfolio return?

Given the challenging year we have all gone through in both the equity and fixed-income markets, it is sometimes human nature to focus on the short term, particularly when it comes to negative returns. However, your BFA investment committee has been through every market environment since the mid-1990s and understands that the markets reward patient investors. First, be very careful in evaluating performance on a short-term basis. If you focused solely on your portfolio’s losses in 2022, you would have overlooked the positive prior three years’ returns. Second, put away any desire to “cash out” to avoid further investment losses, particularly during those periods when volatility is at its greatest and it seems the market only goes down each succeeding day. Missing consecutive days of strong returns by cashing out can dramatically impact your portfolio’s overall performance, especially in its equities.

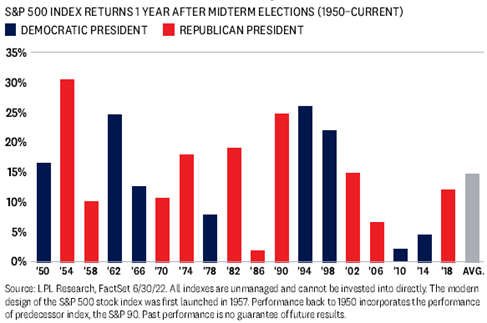

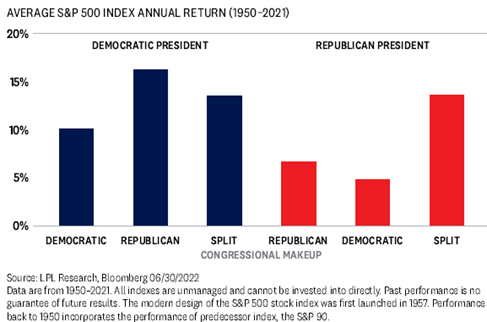

Our partners at Dimensional Fund Advisors (DFA) looked at the growth of $1,000 in the U.S. equity market over the past 30 years both by all-cap (the Russell 3000, from 1997-2021 in Figure 1) and by large-cap (the S&P 500, from 1991-2020 in Figure 2) including being out of the index (market) over the best week, month, etc. As you can see from the following DFA graphs, the results are sobering. It is too late to decide on a course of action when you are in the midst of the storm, so it is good to have a plan already. You can trust your BFA investment committee and rely on your financial plan to help you avoid these mistakes.

Figure 1 (Russell 3000 Index)

Figure 2 (S&P 500 Index, January 1991 – December 2020)

Financial Planning Concepts

WHAT YOU NEED TO KNOW ABOUT SECURE ACT 2.0

On December 23, 2022, President Biden signed into law a $1.7 trillion budget bill that reshapes retirement savings legislation in the U.S. Secure Act 2.0 (“the Act) makes several changes to retirement plans like 401(k), 403(b), IRA and Roth IRA accounts to encourage Americans to save more for retirement. Here are four things that could directly impact your retirement plan strategy:

Required Minimum Distribution Age Increased to 73

Savers in retirement plans are required to make distributions from their tax-deferred savings (401(k)’s, IRA’s, 403(b)’s, etc.) plans when they reach a certain age, previously 72. The new legislation starts with one of the most important of all the provisions by increasing the age at which a minimum distribution is required to 73 from 72 starting in January 2023. It doesn’t help much if you were 72 or older in 2022 but if not, you have one more year before you must begin distributions. In ten years (2033), the Act will move the RMD age to 75.

As a bonus, the 50% tax penalty for failing to withdraw your RMD has now been reduced to 25% in all cases or even to 10% if you take the necessary RMD by the end of the second year.

Emergency Expense Withdrawals from 401(k) and 403(b) Plans

The new legislation now allows an “emergency” distribution from retirement plans. The maximum distribution of $1,000 may be taken once each year. It will not be subject to the 10% penalty typical of withdrawals before age 59 ½ but the money must be repaid within a specified period or no more withdrawals will be allowed for three years.

Catch-Up Contributions Increased

In 2022, savers who are 50 years old or older may make additional contributions to their retirement plans. In 2023, these participants in 401(k), 403(b) or Thrift Savings Plans may defer as much as $22,500 to their retirement savings plus an additional $7,500 catch-up contribution for a total of $30,000. The new Act increases those limits in 2025 for employees aged 60-63 to the greater of $10,000 or 150% of the standard catch-up rate adjusted for inflation. One additional important change occurs in 2024 when ALL catch-up contributions for employees with incomes above $145,000 will be required to be deposited into a Roth account.

Qualified Charitable Distribution (QCD) Limits Set to Increase

Qualified Charitable Distributions are tax-efficient gifts made by those over age 70 ½ directly to charity from an IRA. The distributions are not taxable and help satisfy the required minimum distribution. QCDs are capped at $100,000 per person per year. But starting in 2024, the QCD limit will be adjusted for inflation. Finally, in the past, QCDs were mostly limited to gifts directly to charity. But starting in 2023, the Act allows a one-time gift of up to $50,000 to charitable remainder annuity trusts, charitable remainder unitrusts, or charitable gift annuities. This may be a tax-efficient way to create a lifetime retirement income stream while benefiting a charity at the same time.

As we review your plan, we’ll let you know how Secure 2.0 can help.